How we see the world

Over the years we have seen a lot.

Even before our group was formed the average amount of individual executive level experience averaged 20 years giving us all great perspective in our relative fields of expertise. Being at the cusp of the internet revolution was also very exciting and educational. And of course the large and smaller financial meltdowns of the last decade were also very educational.

Probably the single most important lesson learned in the value of our capital is how hard it was to secure and most importantly how easy it is to lose.

In this section of our website we would like to talk more about the avoidance of the financial mine fields versus the making of money. Over the years we have learned that investors in many cases would just like to have their "return of their investment" over their "return on an investment". In other words, no one wants to lose money.

In recent times we have seen billions of dollars invested in companies that turned out to be based on bio medical hoax technology. These companies have been able to bamboozle even the smartest of board members and brethren venture capital partners. Additionally as early as 1999 over a billion dollars was invested in two companies seeking to change the way groceries were shopped. The business model required avoiding a 100 year old distribution model called grocery stores and delivering via refrigerated trucks groceries to the home. What a concept. But companies did not even last a year post investment.

Recent history is full of examples like these.

Read on and learn more about what we have learned and how we have put those lessons to work.

SEE BELOW

EXPRESSIONS

Capital Markets

With the world currently dealing with a virus pandemic uncertainty is here for the foreseeable future. Capital is king and short term investments are risky ones. The current market swings are not a place to be unless one is a serious experienced investor.

Our more detailed insights are available by joining our email list.

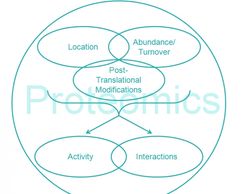

Proteomics

With the Human Genome Project has come huge strides in the study of protein composition, stucture and activity. This very complex area of study looks to be at the heart of many future medical breakthroughs. Should you want to stay informed and want to receive our analyst's newsletter please let us know.

Functional Foods

Even the every day consumer of Mc Donald's burgers knows that what we eat can be a poison or a medicine. Food as medicine is becoming the new diet craze. Countries like Sweden are boasting 17% vegans in their population. Companies like Nestle and Unilever are making radical changes in their corporate persona so that the world sees them as "all natural". Sugar is now equivalent to poison and salt is right there too. In the weeks to come we will be showing more information on this very timely subject.

Adult Stem Cells

Secure Investments

CES Capital has been involved in adult stem cells for over 10 years.. Phenomenal strides have been made such that today many physicians are treating patients with their own stem cells. We have learned that even dead cells in the right conditions can help live cells do their work better..These very resilient cells can help grow bone, tissue and help fight serious medical conditions. The word, Immunottherapy will soon be a mainstream medical term. Look to CES to continue to invest in this truly magnificent areas of science.

MicroGreens

Secure Investments

Secure Investments

Today nutritional value is on the minds of most health conscious individuals. Food analysts have shown that small nutritionally packed plants called Micro Greens are at the top of the list when it comes to nutritional value. And because these small plants on average are harvested every 8 days the math shows that these greens in the right market could out profit even cannabis and hemp in the future. CES has a lot of experience with these greens. If you want to know more contact us.

Secure Investments

Secure Investments

Secure Investments

CES Capital Group has a strong belief that even the most risky of investments could be securitized such that in the event of a total loss of the investment investors could be made whole. In 2002 CES began an internal program to calculate loss ratios and to look at how to predict success and loss. Today these models are complete and we believe there is good reason to believe a Securitized Venture Investment (SVI) is possible.

Contact us should you want more information about SVI